For Strategic Capital, Inc. (SC), integrating ESG concepts and taking active Ownership is part of our commitment to deliver long-term returns and upholding our fiduciary duty. With this in mind, SC has signed the United Nations Principles for Responsible Investment (“UN PRI”), expressed our support for the Task Force on Climate-related Financial Disclosures (“TCFD”) Recommendations and announced our acceptance of the “Japan stewardship code”.

Although it has been several years since Japan has implemented Corporate Governance (CG) reform, many Japanese companies are still only pretending to comply with the CG Code and do not understand the true principles. A term used to describe this type of action is “G washing”. As such, shareholder value for many Japanese companies remains below intrinsic value, and SC continues to see numerous opportunities for an activist to improve CG and unlock that value. That is why SC, unlike some other investors in Japan, is proud to be described as a shareholder activist investor”.

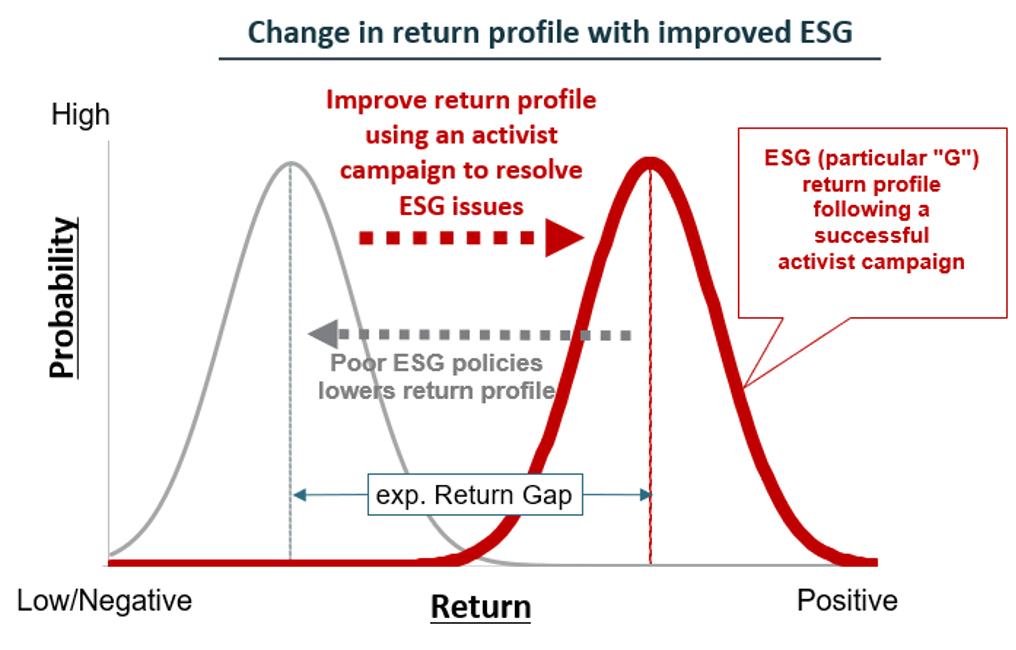

SC invests in companies that have poor CG to start and actively pressures management for improvements (“activist campaigns”). While G is the most integral to such investment process, E and S are also pivotal to improve the return profile of its investee companies (see chart below). Based on the assumption that activist campaigns are impactful, the return profile will then shift to the right (red graph). It can also be thought that the return profile had shifted to the left due to the companies’ poor ESG practices in the past.

SC believes that Environmental factors can increase / decrease shareholder value by lowering / raising cost of equity. Although SC does not have a particular threshold for Environmental factors such as CO2 emission, waste of water or other issues, companies are encouraged to reduce such risks by divestment of the business which is related to coal and thermal power generation plants, by disclosing quantitative data and establishing the appropriate policy for the companies (e.g. CO2 reduction targets) as part of its ongoing engagement with themselves.

Social factors are identified in labor or human rights violations, breach of legal compliance (e.g antitrust violations), investment in gambling (a.k.a. PACHINKO in Japan), questionable payments to concerned parties. SC believes these issues are risks which could materially reduce shareholder value, while on the other hand can in turn increase shareholder value by resolving such issues.

SC believes that poor Governance has resulted in an impairment to shareholder value. Examples of the “poor Governance” are use of poison pills, poor board composition, facilitating allegiant shareholders, cross-shareholdings and numerous other poor decisions due to ignorant or selfish actions of the Board of Directors. As such, SC’s strategy is based on the core belief that (i) an improvement in Governance will lead to an increase in shareholder value, and (ii) considerable resources should be allocated to all steps of the investment process, in order to identify and resolve the issues.

Before adding a new stock name to the portfolio, SC researches and analyzes the company from fundamentals, valuation and ESG perspective. Identifying the material ESG factors is the primary focus and investment are selected based on the belief that improvements in ESG will lead to unlock shareholder value. After such investment, SC takes actions based on the ownership of the companies (i.e. activist campaign, dialogues etc) on ESG issues so as to educate and press for improvements.

SC publishes the results of its voting, together with the reasons on its website annually. All the voting and the voting policy which incorporates ESG factors are determined by the Investment Committee and reported to the Board Meeting. Please find the detail here.

April 2021, Enactment

October 2021, Revision