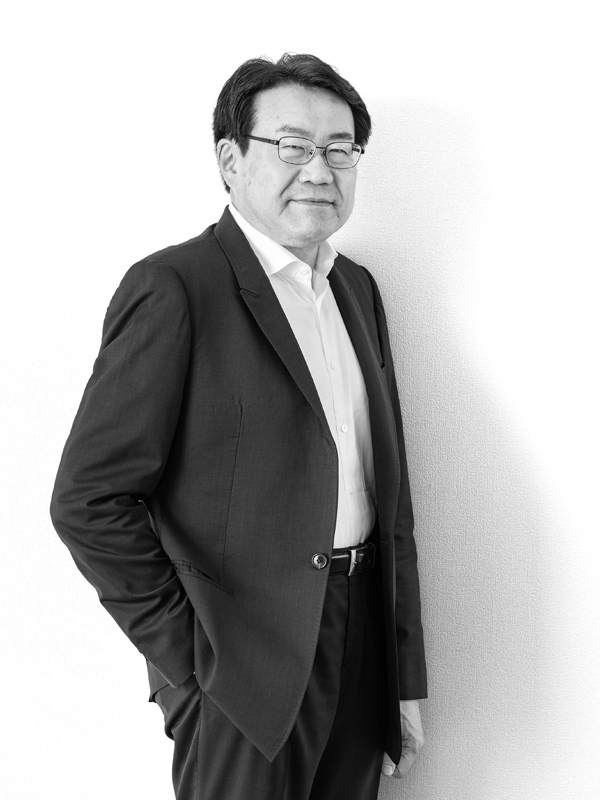

Tsuyoshi started his career with Nomura Securities where he underwrote hundreds of deals for Japanese companies and government agencies; led IPOs for the privatization of national companies; advised government agencies on injecting funds into Japanese banks; and was responsible for the tender offering of a Japanese listed subsidiary of a US company.

In 1999, he helped launch M&A Consulting (later called MAC Asset Management) where he was Head of Investment Management for the first activist fund in Japan.

In 2012, he founded Strategic Capital as both president & CEO and subsequently launched the Japan Up activist strategy fund in December of that year.

Tsuyoshi holds a B.A. in Law from Tokyo University.

ICGN Member.