Strategic Capital, Inc. (SC) is the manager of a fund that holds approximately 5.0% of Japan Securities Finance (JSF).

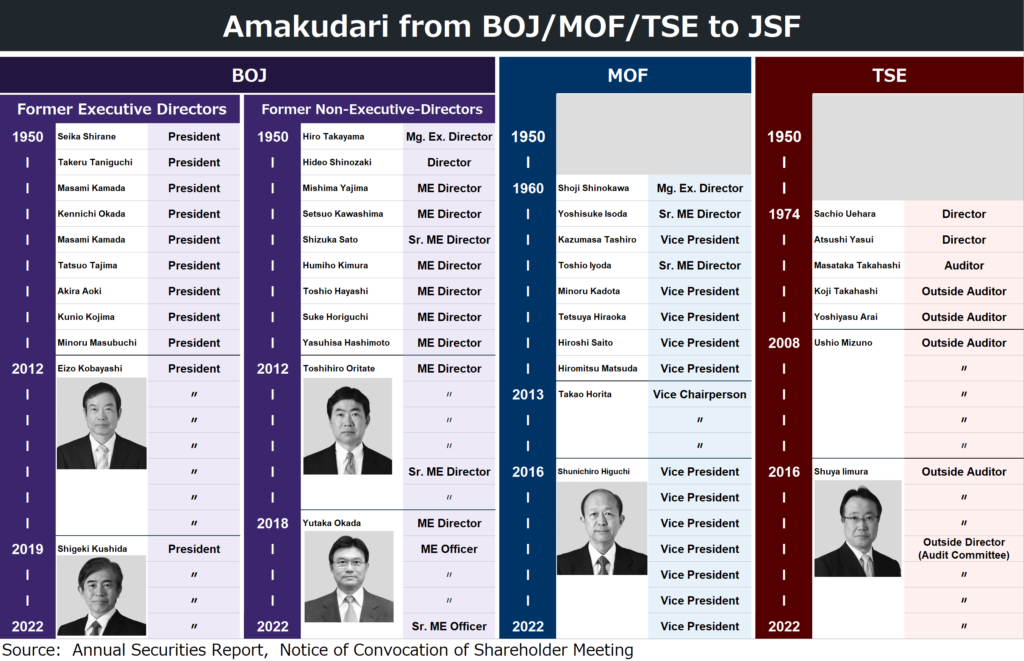

Since listing on the Tokyo Stocks Exchange (TSE), the Bank of Japan (BOJ), the Ministry of Finance (MOF) and the TSE have long been using JSF’s director and officer positions as an amakudari[1] destination. Therefore, we have requested to convene an extraordinary general meeting of shareholders (EGM) because we believe the amakudari is damaging the shareholder value of JSF from the viewpoint of S (Society) and G (Governance) of ESG.

We hope that all of JSF’s shareholders will support our shareholder proposal from the perspective of S and G.

Please see our special website (here) for more details on the harm caused by amakudari, the breakdown of governance and the proposal.

[1] amakudari – (天下り,literally “descent from heaven”) is a metaphor for the institutionalized practice where Japanese senior bureaucrats retired to high-profile positions in the private and public sectors.

Strategic-Capital-has-requested-an-Extraordinary-General-Meeting-of-Shareholders